We want to thank The Business News and Rachel Kroeger for the wonderful article featuring our own Founding Attorney and Managing Member, Evan Y. Lin, and our firm, Lin Law LLC. Check out the article with the link below:

Category Archives: Uncategorized

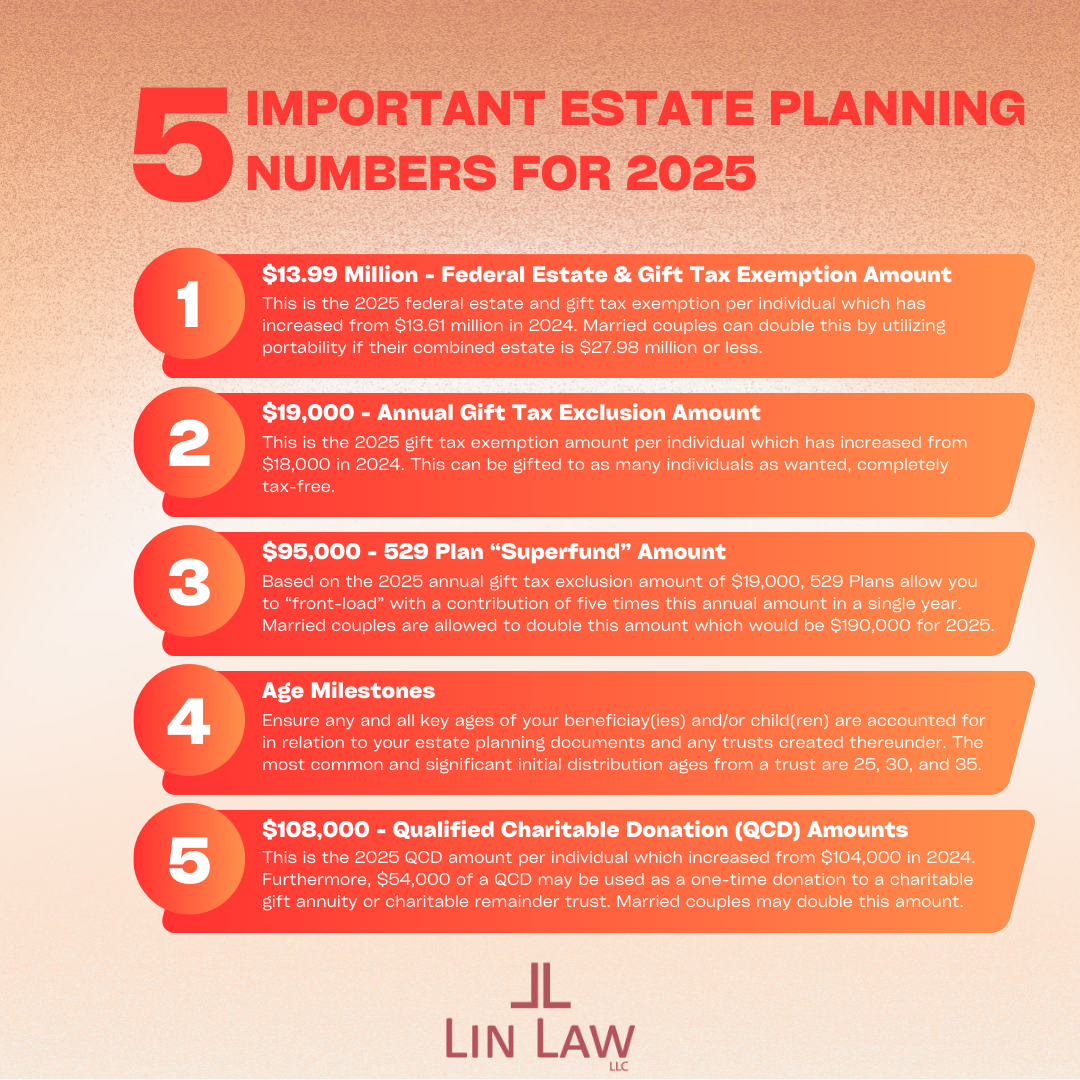

🎆📊 Estate Planning Numbers You Need to Know for 2025 📊🎆

The New Year is here, and with it, it brings many opportunities that can have a significant impact when it comes to your estate plan. Here’s a quick breakdown of the five important numbers mentioned above for 2025 and why they matter:

🔻$13.99 Million – Federal Estate & Gift Tax Exemption Amount:

This is the increased amount for 2025 that you have the ability to pass on to your heirs tax-free as an individual. If married couples elect portability, they may combine their exemptions totaling $27.98 million. If your total estate exceeds this amount in any capacity, it may be subject to the federal estate tax. Along with this, the estate tax exemption is scheduled to “sunset” at the end of 2025 and is estimated to decrease by being halved to $7 million per individual.

🔻 $19,000 – Annual Gift Tax Exclusion:

When it comes to the annual gift tax exclusion amount, you may gift this to as many individuals as you would like tax-free. This is a powerful tool for transferring wealth that many people utilize to reduce their taxable estate as it can directly benefit loved ones and are able to see the impact within your lifetime.

🔻 $95,000 – 529 Plan “Superfund” Amount:

The 529 Plan is a very common way that many grandparents, that are fortunate enough to have the means to do so, are able to contribute to their grandchildren’s education. With that being said, the 529 Plan is a tax-advantaged account that an account owner sets up for a minor beneficiary and can be used to pay for any education expenses up until they turn eighteen. Furthermore, by “superfunding” a 529 Plan it allows the account owner to contribute five times the annual gift exclusion amount ($19,000 in 2025) in a single year. In 2025, if an account owner “superfunds” a beneficiary’s account the amount contributed would be $95,000 and this can be doubled for married couples totaling a contribution of $190,000. However, it is important to note that if the account owner decides to “superfund” a beneficiary’s account that they may not contribute any “gifts” to the beneficiary within the next five years or within that year. All in all, the 529 Plan is a wonderful way for grandparents, parents, friends, and others to contribute to a beneficiary’s academic journey.

🔻 Age Milestones for Beneficiaries:

Estate planning is about more than just protecting assets, it’s also about ensuring they are passed down at the right time as well. In this upcoming year, if you have an estate plan it’s important to know if your selected beneficiary(ies) will be turning the pre-selected distribution age and if they are mature enough for this milestone. Delaying inheritance ages till later ensure that your beneficiary(ies) will have better financial responsibility and can provide long-term security. Lastly, if a child of yours or someone that you are a guardian of that will turn eighteen this year, it may be worth it to look into having them acquire their powers of Attorney.

🔻$108,000 – Qualified Charitable Donation (QCD) Amount:

In 2025 for individuals that are 70 ½ and above, they have the ability to contribute $108,000 annually from their IRA to a qualified charity, tax-free. This allows the individual to leave behind a legacy that is meaningful to them that will have a lasting impact while also taking advantage of tax benefits.

Estate planning is more than just numbers, it is being able to create a tailored strategy that is reflective of your lifetime goals and your personal values. In regard to these 2025 updates, an annual review of your estate plan is always a good way to ensure peace of mind when it comes to tailoring the best strategy for you and your loved ones.

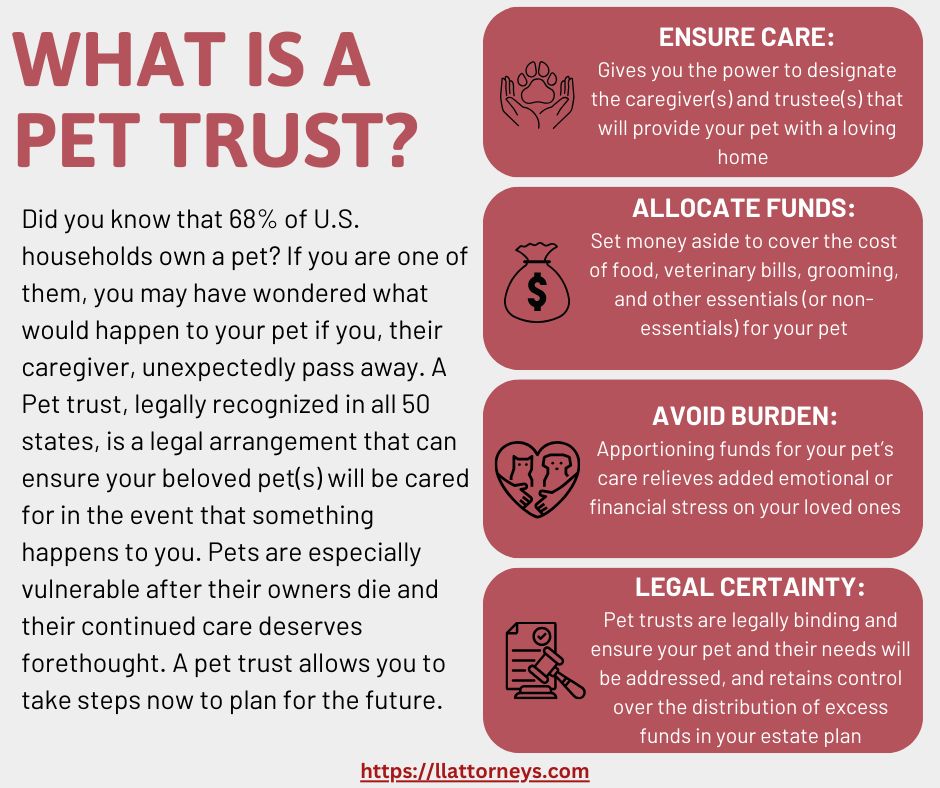

Everything You Need to Know About Pet Trusts

Yes, a pet trust is really a thing. For many, pets are as much a part of the family as you or I. They may not be able to say so, but they deserve a plan, too. Pet trusts are legally binding arrangements that ensure your pet(s) are cared for, according to your wishes, if you are unable to do so due to illness, disability, or passing away. Similar to a trust with human beneficiaries, it allows you to set funds aside specifically for your pet’s needs, appoint one or more trustees to manage the trust’s assets, designate one or more caregivers for your pets, and give detailed instructions for their care. If necessary or desired, you can also compensate the caregiver for your pet’s care. If there are any funds leftover after your pet’s death, you decide who will receive those funds, whether it be your pet’s caregiver, divided among your family or other beneficiaries, or to a charity of your choosing. Pet trusts can provide people with a peace of mind and a sense of certainty that their pet is accounted for and a plan is in place to meet their needs. A pet trust ensures that your beloved companions would continue to receive the love and care that they are used to, no matter what.

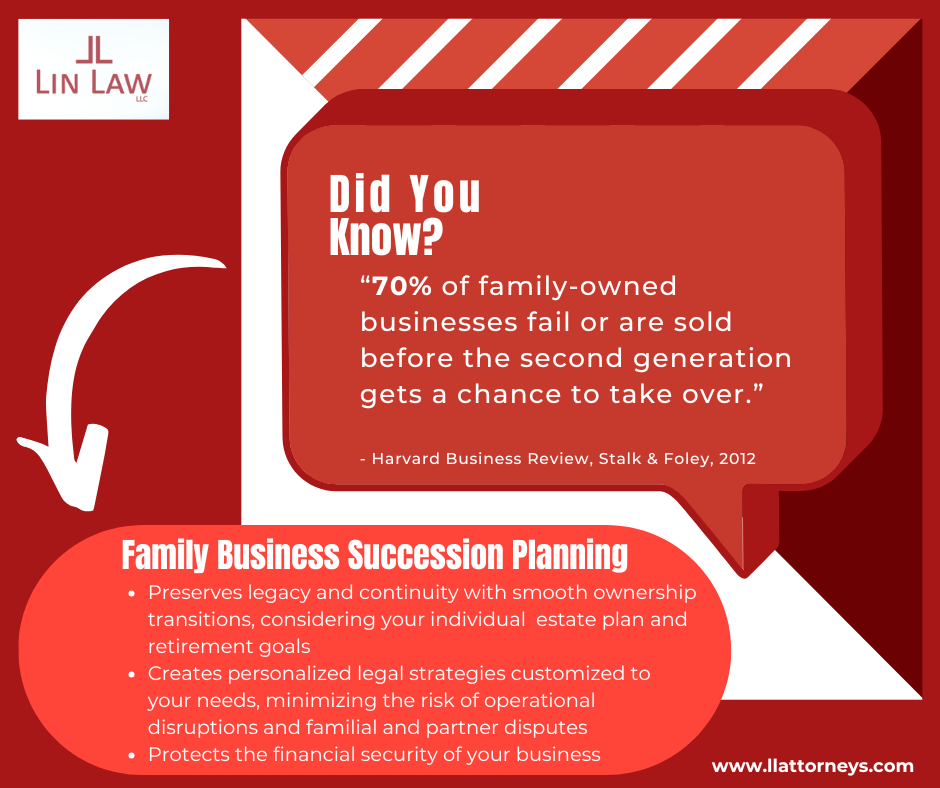

👪 Estate Planning Essentials: Protect Your Legacy and Don’t Let Your Family Business Fall into the 70% 👪

The Harvard Business Review article “Avoid the Traps That Can Destroy Family Business” mentions the statistic that seventy percent (70%) of family-owned businesses do not make it to the second generation. Furthermore, if you don’t want your business to fall into that statistic then proper family business succession planning will be vital to preserving the values, vision and foundation you’ve established for many generations to come. Below we have outlined what we think are key considerations to creating a successful family business succession plan and transition:

🔑 Key Steps for Successful Family Business Succession Planning:

1. The Business Plan:

– Evaluate and assess the business’s current value and its potential for long-term growth

– Choose your successors who will help the business flourish according to your wishes

– Develop a transition strategy with the help of an attorney to outline how how the responsibilities will be transferred along with a timeline

2. The Estate Plan:

– Determine the business and personal asset distribution you want to be divided among your heirs

– With the help of an attorney, ensure the proper legal documents (i.e., living wills, trusts, operating agreements, etc.) are created with clear details to ensure a smooth business ownership transition which will mitigate risk and any potential disputes

– Ensure the best fitting tax strategies are implemented that account for any estate taxes and reduce future financial issues for heirs

3. The Exit Plan:

– Define clear exit goals that consider the transfer of ownership, sale of the business, if you hypothetically want to close it down, and what you want to achieve with all of this in mind

– Prepare the business by improving its value, addressing any issues and optimizing the operations if you plan to sell it

– Take into account the financial and personal impact this will have and adjust your plan accordingly

All in all, family business succession planning helps guarantee that your hard work stays in trusted hands for generations to come. By incorporating your family business success plan into your estate plan, it will address the complexities of ownership transition, division of personal property, minimize taxes, and allow the growth of your business to flourish.

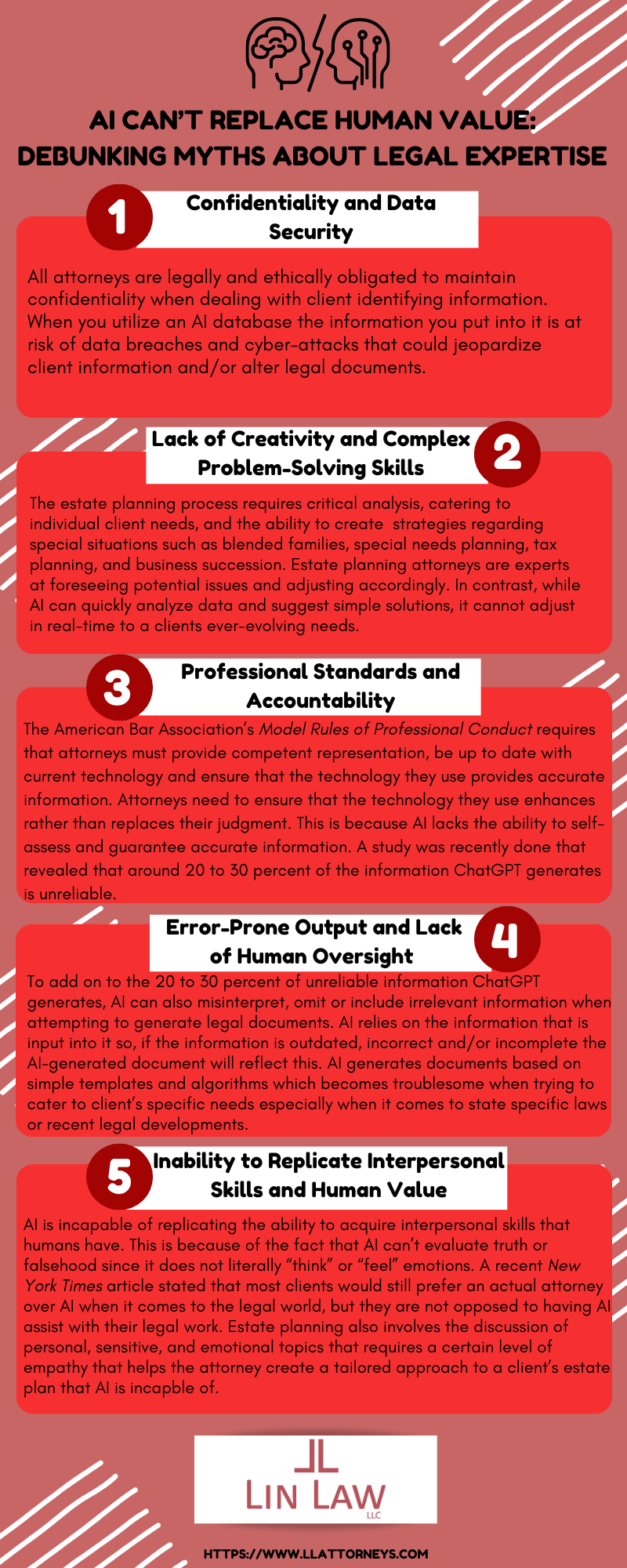

🤖AI Can’t Replace Human Value: Debunking Myths About Legal Expertise 🤖

In light of artificial intelligence’s (AI) present-day developments, more specifically, in regard to the context of recent claims that AI might replace human professionals, this infographic features critical weaknesses and shortfalls of AI in relation to estate planning practices. Additionally, this serves as a reminder that while AI is an impressive and seemingly all-encompassing tool that it ultimately can’t replace human value that is essential to the intricate practice of legal work. As of right now, it is impossible to completely rely on AI to create legal documents because it would require the client’s informed consent. Although in the near future within the legal world, AI should be able to assist with drafting, analyzing data, and increasing the efficiency of these tasks. It is important to address the broader conversation regarding AI’s role in the workforce, as it could replace certain low-skilled jobs by making routine tasks automated, however, this will ultimately drive the demand for higher-skilled professionals to refine their own expertise and work together rather than against AI to enhance their practice. The infographic portrays how AI does not have the ability to make ethical decisions, interpret complex legal issues (i.e., state-specific laws, individualized tax planning, court interpretation, etc.), and/or provide empathetic guidance.

Ultimately, AI didn’t attend law school and does not have adequate comprehension of legal principles or the essential moral compass that human lawyers acquire. All in all, the future of work in the legal world isn’t about whether AI will replace human professions but rather how human professionals can utilize AI as a tool to enhance their abilities. The future lies in collaboration, where attorneys use AI as a tool rather than a replacement to ensure that legal work is kept confidential, accurate, caters to each client’s individual needs, and is, most importantly, legally sound and enforceable.

Wisconsin Embraces Remote Notarization for Estate Planning Documents

By Attorney Curtis A. Edwards

In a progressive move to modernize the legal process of executing estate planning documents, on March 21, 2024, Governor Tony Evers signed into law SB 898 (Wisconsin Act 130), which establishes a procedure for the remote notarization and/or witnessing of estate planning documents.

While remote notarization of other types of documents has been possible under Wisconsin law since 2020, estate planning documents have been an exception due to the need for more stringent protocols. The new legislation marks a significant shift in how individuals can legally execute crucial estate planning documents, ensuring accessibility and convenience while upholding the integrity of the law and the documents being executed.

The new legislation encompasses a wide array of estate planning documents, including wills, trusts, powers of attorney, health care directives, and marital property agreements. The comprehensive nature of the law demonstrates the state’s commitment to facilitating essential legal transactions in an increasingly digital world.

Under the new law, remote notarial acts relating to estate planning documents must adhere to stringent procedures outlined in section 140.147 of the Wisconsin Statutes. Unlike other remote notarization processes, estate planning documents necessitate supervision by a Wisconsin-licensed attorney in good standing. This provision ensures that legal oversight is maintained throughout the remote execution process, safeguarding against potential fraud or misconduct.

Crucially, the use of audiovisual communication technology is mandated to enable real-time interaction between the notary, supervising attorney, remotely located individual, and any witnesses. This ensures transparency and accountability, mirroring the traditional in-person notarization process while leveraging technological advancements for greater efficiency and access.

Additionally, remote notarization of estate planning documents requires confirmation of the signer’s physical presence in Wisconsin, along with stringent identity verification measures. These include personal knowledge or production of government-issued credentials to authenticate the signer’s identity and location.

During the remote signing process, individuals must declare their understanding and voluntary execution of the document, and the document must specifically reference that it is being executed pursuant to section 140.147 of the Wisconsin Statutes. Upon completion, the notarized document is forwarded to the supervising attorney for retention and archiving, ensuring a record of the document is made.

The legislation further mandates the completion of an affidavit of compliance by the supervising attorney, affirming adherence to the statutory requirements. This affidavit serves as a crucial record of due diligence, providing additional assurance of the document’s validity and legality.

Overall, SB 898 represents a significant step forward in modernizing legal practices in Wisconsin, providing individuals with greater flexibility and accessibility in executing vital estate planning documents. By embracing remote notarization, the state reaffirms its commitment to innovation while upholding the highest standards of legal integrity and protecting against fraud and misconduct.

If you have any questions or are interested in learning more about this topic, please contact Lin Law LLC at (920) 393-1190.

“It’s all about relationships.” Evan Lin builds Green Bay law practice on trust – Omar Waheed

On July 20, 2023 Omar Waheed, from Blueprint365, interviewed Attorney Evan Lin and published an article. To read, click here!

“It’s all about relationships.” Evan Lin builds Green Bay law practice on trust

Utilizing a Washington Will in Wisconsin: An Effective Probate Avoidance Tool in Marital Property Agreements

By Attorney Curtis A. Edwards

Wisconsin’s Marital Property Act empowers married individuals to customize the disposition of their assets during their life and after death through marital property agreements. One such provision that can significantly impact estate planning is the “Washington Will” provision, so named because of its origin and use in Washington State. This provision allows a married couple to seamlessly transfer assets upon death without the need for probate, simply by providing so in their marital property agreement.

Act empowers married individuals to customize the disposition of their assets during their life and after death through marital property agreements. One such provision that can significantly impact estate planning is the “Washington Will” provision, so named because of its origin and use in Washington State. This provision allows a married couple to seamlessly transfer assets upon death without the need for probate, simply by providing so in their marital property agreement.

Understanding the “Washington Will” Provision:

The “Washington Will” provision enables married couples to bypass the probate process upon the death of either spouse. By incorporating this provision into their marital property agreement, couples can direct the transfer of certain assets to specific beneficiaries, i.e. persons, trusts, or entities, without the need for a traditional last will and testament and without probate.

Avoiding Probate through Nontestamentary Disposition:

Traditionally, assets are distributed according to a will, which undergoes probate – a court-supervised process that can be time-consuming and costly. However, with a marital property agreement containing a “Washington Will” provision, designated assets are transferred directly to beneficiaries through nontestamentary disposition. This means that the assets pass to the intended recipients outside of the probate process, providing a more efficient and private transfer.

Simplifying Estate Administration:

The inclusion of the “Washington Will” provision simplifies estate administration for surviving spouses and their beneficiaries. Without the burden of probate, the transfer of assets designated in the agreement can occur swiftly, allowing beneficiaries to access their inheritance promptly. For example, the “Washington Will” provision can direct that all property transfer to the surviving spouse upon the first spouse’s death without probate.

Conclusion:

The “Washington Will” provision within Wisconsin marital property agreements is an instrument that allows married couples to exercise greater control over the distribution of their assets upon death. By avoiding probate and providing a clear roadmap for asset transfer, this provision simplifies estate administration, and ensures that the wishes of each spouse are upheld.

If you have any questions or are interested in learning more about this topic, please contact Lin Law LLC at (920) 393-1190.

Demystifying Probate: Understanding the Process of Estate Administration?

by Attorney Curtis A. Edwards, J.D.

A. Edwards, J.D.

Probate—a legal process that can often appear complex and intimidating. In this article, we aim to provide a clear and concise explanation of the probate process, shedding light on its purpose and the steps involved. Whether you’re a personal representative, beneficiary, or simply seeking to better understand the probate process, this article will help demystify the fundamentals of estate administration.

What is Probate?

Probate is a “court-supervised” legal procedure that oversees the administration of a deceased person’s estate, including the distribution of assets and settlement of any outstanding debts. In light of the court’s jurisdiction over the probate process, it ensures that the wishes outlined in the deceased’s will (if one was created) are respected and that the estate administration is carried out in accordance with applicable laws. Probate also provides a forum to resolve any disputes that may arise during the distribution process.

Initiating the Probate Process

The probate process typically begins with the filing of a petition in the appropriate court. The court validates the will, if one exists, and appoints a personal representative consistent with the deceased’s will to administer the estate. If there is no will, the court will appoint a personal representative to oversee the distribution of assets based on the laws of intestacy (default rules for distribution when no will exists).

Inventory and Valuation of Assets

The personal representative’s first task once probate has been initiated is to create an inventory of the deceased person’s assets. This includes identifying and documenting all real estate, bank accounts, investments, personal belongings, and other assets. It’s important to assess the value of these assets accurately, often with the help of appraisers or experts, to determine their fair market value.

Notifying Creditors and Settling Debts

During the probate process, the personal representative must notify creditors of the deceased person’s passing. This provides an opportunity for creditors to make claims against the estate for any outstanding debts. The personal representative will then review and settle any valid claims using the assets of the estate. Resolving debts is a crucial step in the probate process to ensure that the remaining assets can be distributed to the beneficiaries.

Distribution of Assets

Once all debts, taxes, and expenses have been settled, the personal representative proceeds with the distribution of assets. This involves transferring ownership of assets to the beneficiaries as outlined in the will or according to the laws of intestacy. It is important to follow the proper legal procedures to ensure a smooth and lawful transfer of the assets of the estate.

Challenges and Timeframes

The probate process can be affected by various factors that may cause delays or complications. These may include disputes among beneficiaries, complex asset structures, or disagreements over the validity of the will. The duration of probate can also vary depending on the size and complexity of the estate.

Conclusion

Probate, though initially daunting, is a necessary legal process that ensures the proper administration and distribution of a deceased person’s estate. Understanding the basic steps involved in probate can provide clarity and help individuals navigate this process more confidently. It is advisable to seek professional legal guidance from an attorney specializing in probate law to ensure compliance with Wisconsin law and to address any unique circumstances that may arise during the probate process.

If you have any questions or are interested in learning more about this topic, please contact Lin Law LLC at (920) 393-1190.

The Business News Article: “People Who Make a Difference – Evan Lin”

On May 8, 2023 The Business News published an article about Attorney Evan Lin titled “People who make a difference – Evan Lin”. To read, click here!