By Attorney Curtis A. Edwards

A. Edwards

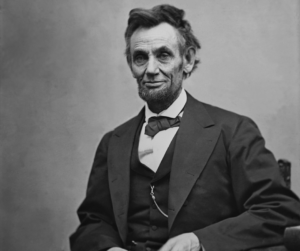

On the evening of April 14, 1865, Abraham Lincoln attended a performance of the play “Our American Cousin” at Ford’s Theatre in Washington D.C. As he watched the play, unaware of the tragic events that were about to unfold, he was simply a man enjoying a night out at the theater. Little did he know, that John Wilkes Booth, a well-known actor and Confederate sympathizer, would soon enter the theater’s presidential box and fatally shoot Lincoln. You may be surprised to learn that when Lincoln was pronounced dead the following morning on April 15, 1865, he died intestate, that is without a will, setting off a prolonged legal battle over his estate.

At the time of Lincoln’s death, his estate was valued at approximately $110,000, which was a substantial sum of money in 1865. Without a will, his estate was subject to the Illinois Probate Act, which dictated that his property be administered through the court supervised probate process. Under the intestate laws of Illinois, Lincoln’s property was to be divided equally among his widow and two sons. However, complications arose because Lincoln’s estate included real estate in multiple states and other assets held in Washington, D.C., adding to the overall complexity and duration the process.

Additionally, Lincoln’s estate included his personal papers and books, which were deemed valuable because of his status as a former president. His widow, Mary Todd Lincoln, claimed ownership of the papers, while Lincoln’s son, Robert, argued that they belonged to the estate. Despite the estate being administered by friend and Supreme Court Justice David Davis, the dispute over Lincoln’s estate went on for years, something Lincoln’s family undoubtedly would have preferred to avoid.

Given his background as an Attorney, Lincoln would have certainly understood the importance of having a will, so it is peculiar that he never took the time to create one. Perhaps he believed that his estate was relatively simple and did not require a will, or like many he may have simply procrastinated the task.

Regardless of the reasons, the challenges faced by Lincoln’s estate as a result of him dying without a will illustrate the importance of having a solid estate plan in place, regardless of profession or status. Even as a sitting president, Lincoln’s estate was still subject to the traditional probate process and his property and assets were ultimately distributed according to the default intestacy laws.

While Lincoln may be remembered primarily for his contributions to American history, his estate serves as a cautionary tale for those who neglect to plan for the future. By taking the time to create a comprehensive estate plan, individuals can help ensure that their legacy is preserved and their loved ones are provided for, even after they are gone.

If you have any questions or are interested in learning more about this topic, please contact Lin Law LLC at (920) 393-1190.