🚨Corporate Transparency Act Update: What You Need to Know in April 2025 🚨

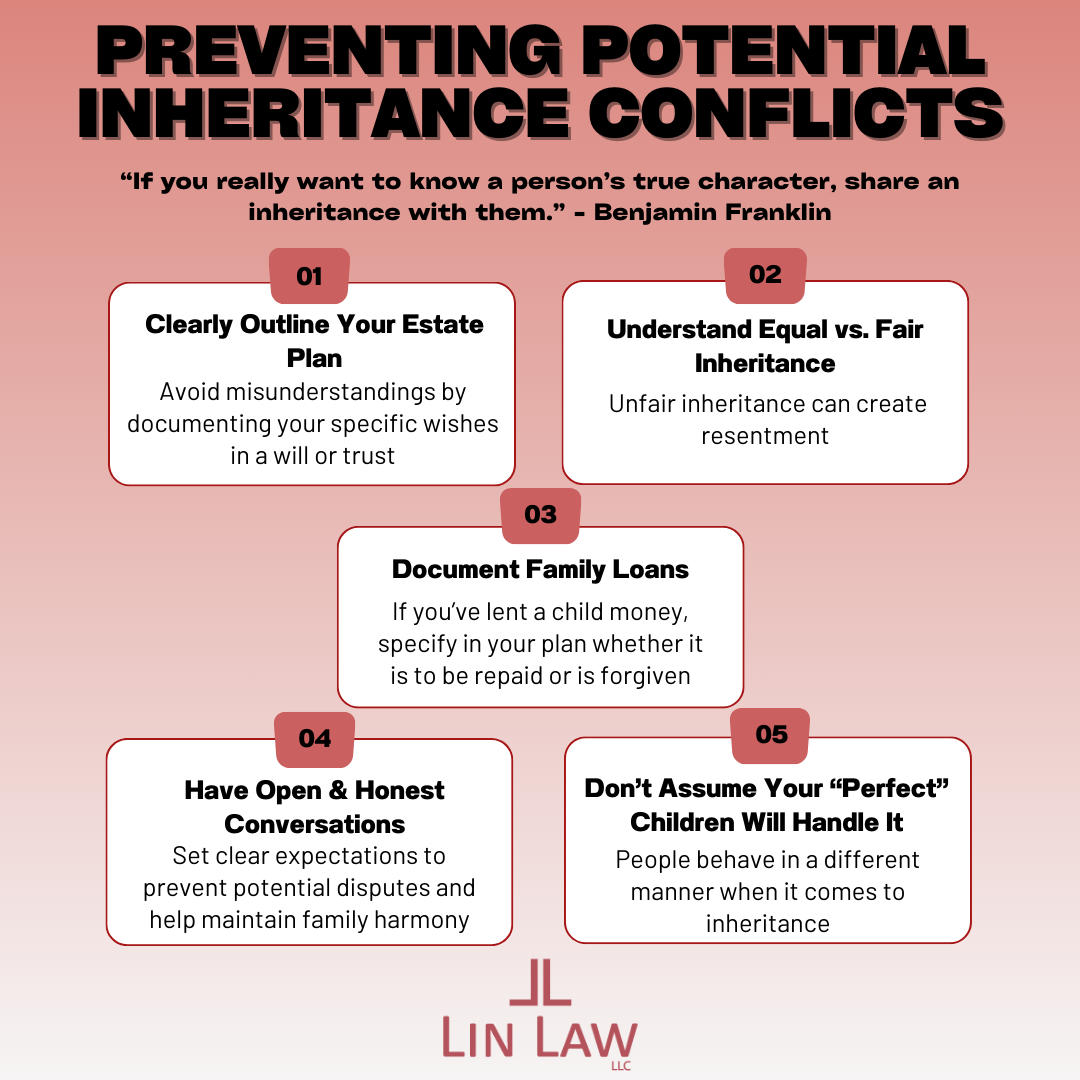

As one would expect, many parents and/or grandparents assume that their children and/or grandchildren will handle inheritance matters amicably when it comes time to receive their share. However, after years of experience in the estate planning industry, it has become clear that this is rarely the case. A different side of a person often comes out when inheritance is involved which is why these types of conflicts within families are unfortunately extremely common. Without proper planning practices in place, disputes over inheritance amounts, real estate, or loans can damage family relationships beyond repair. Although the ability to recognize potential problems is already a significant part of its solution so, here’s our recommendations you should consider to help ensure smooth transitions:

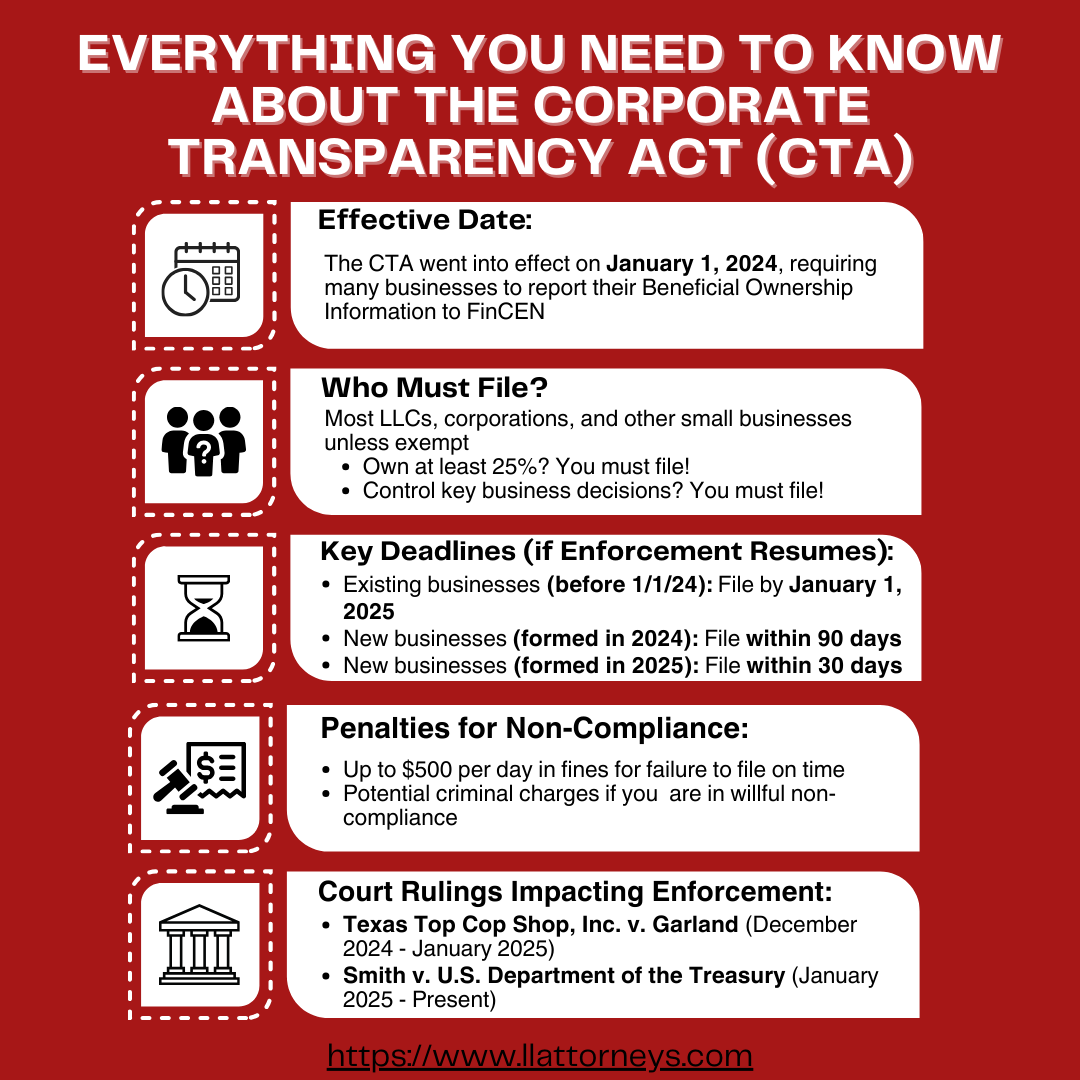

One of the major developments in estate planning and corporate law was the passage of the Corporate Transparency Act (CTA), which went into effect on January 1, 2024. The CTA impacted almost all LLCs, corporations, limited partnerships, and other closely held business entities by creating a requirement that a “Beneficial Ownership Information Report”, or “BOIR”, be filed with the Financial Crimes Enforcement Network (FinCEN), a federal bureau within the United States Department of the Treasury. Subject to a few limited exceptions, this reporting requirement applies to all business entities with less than 20 full time employees. In the BOIR, entities and their owners were required to provide personal identifying information on all individuals that exercise substantial control over the entity, as well as all individuals that own or control at least 25% of the entity’s ownership interests. The CTA’s overall purpose is to prevent the use of companies, such as corporations, limited liability companies, and various forms of limited partnerships, to obscure illicit activities and to increase business operations ethics and transparency. In Furtherance of these objectives, the CTA requires businesses, subject to a few exceptions, to disclose information regarding individuals who own at least twenty-five percent (25%) or exercise majority control over the company must report their information.

As of the present date, there are two cases challenging the constitutionality of the CTA. Under both cases (Texas Top Cop Shop v. Garland and Smith v. U.S. Department of the Treasury), nationwide injunctions were enacted preventing enforcement of the CTA. For the time being, reporting companies are not required to file BOIRs with FinCEN. However, the injunctions have been previously lifted only to be subsequently re-enacted as they have made their way to the U.S. Supreme Court. On December 3, 2024, the U.S. District Court for the E.D. Texas in Texas Cop Shop enacted a nationwide injunction that temporarily blocked enforcement of the CTA. A second injunction soon followed in Smith. Then, on December 23, 2024, the nationwide injunction was lifted when it was overturned by the Fifth Circuit Court of Appeals. Scrambling, and in recognition that many reporting companies stopped filing their BOIR, FinCEN extended the deadline to file an initial BOIR to January 13, 2025. Before the January 13 deadline, the U.S. District Court for the E.D. Texas issued another nationwide injunction in Smith. While the nationwide injunction remains in place under Smith, the U.S. Supreme Court has indicated a willingness to uphold the validity of the CTA when they lifted the nationwide injunction enacted in Texas Top Cop Shop on January 23, 2025.

It is critical to ensure you are compliant with the CTA reporting requirements. If enforcement of the CTA resumes, non-compliant companies could face substantial penalties, including fines of five-hundred dollars ($500) per day and/or possible additional penalties and criminal charges for intentional violations. Going forward, if the CTA is upheld, FinCEN will likely extend initial reporting deadlines for any entities that have not yet filed a BOIR. This was the case following a temporary lifting of the nationwide injunctions on December 23, 2024, when the initial reporting deadline was extended to January 13, 2025. Entities formed after January 1, 2025, must file their initial BOI report within thirty (30) days of their formation. In order to ensure compliance, if necessary, it is also critical to monitor the progress of these cases as they proceed to the U.S. Supreme Court on their merits. If ultimately upheld, new deadlines for compliance will likely be imposed.

Lastly, if the CTA is ultimately upheld, it is important to keep in mind that the initial BOIR filing is only the first requirement under the CTA. Each instance where the information reported for a beneficial owner changes (including, but not limited to, if the reporting company’s address or name changes, if ownership composition of the reporting company changes, or if an owner’s name or address changes), then a subsequent BOIR must be reported within 30 days of such change.

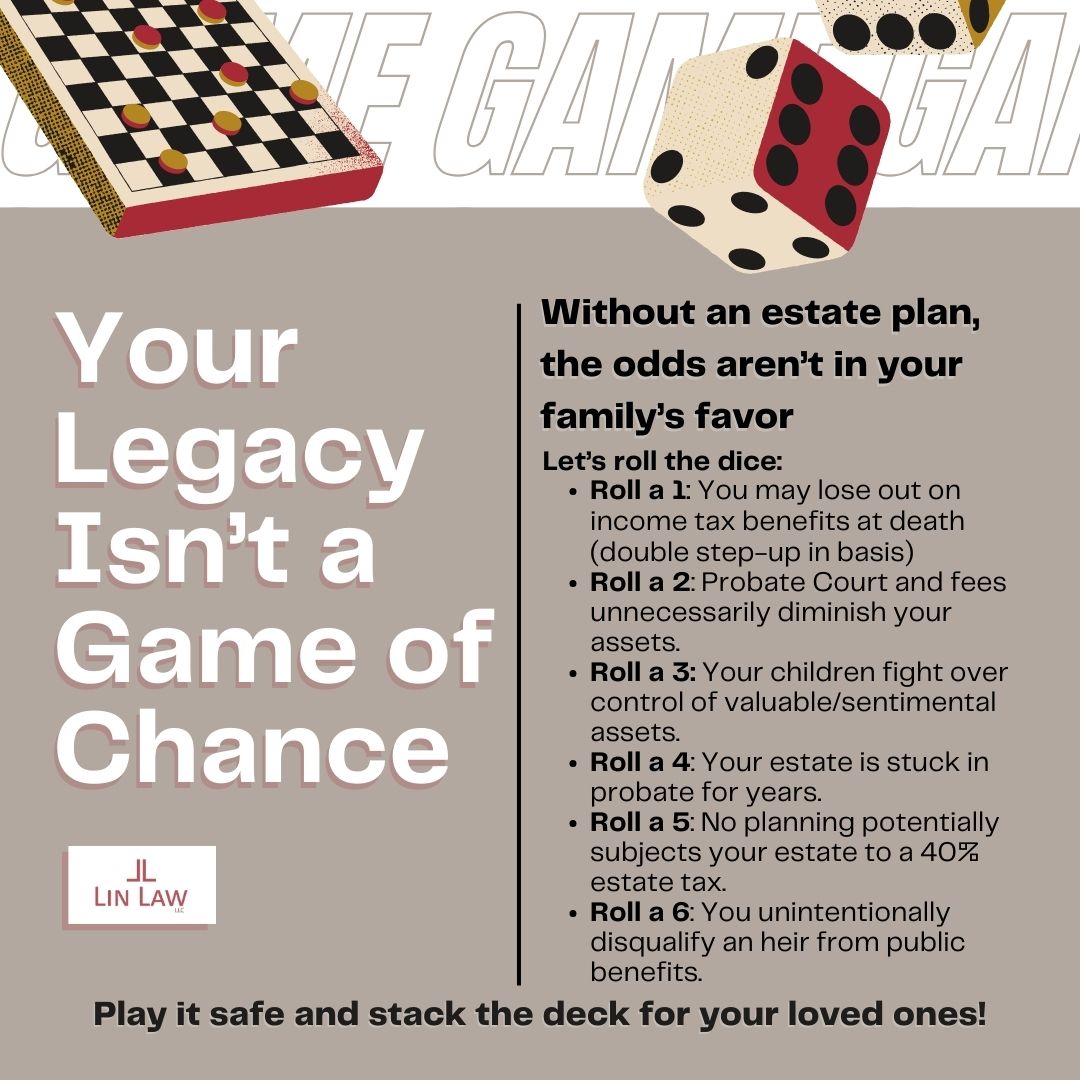

Your legacy isn’t meant to be a game for your family to play. In the event of your passing, an estate plan ensures your affairs are organized and tailored to your wishes. Many people avoid planning their estates, leaving the responsibility to the state. Without a designated plan, the law will decide for you—or worse, it could lead to family disputes over who gets what. In most cases, the court’s decisions may not align with your intentions. With the new year already underway, take the opportunity to get ahead and start planning your inheritance. After all, no one knows better than you what you want for your legacy and loved ones!

We want to thank The Business News and Rachel Kroeger for the wonderful article featuring our own Founding Attorney and Managing Member, Evan Y. Lin, and our firm, Lin Law LLC. Check out the article with the link below:

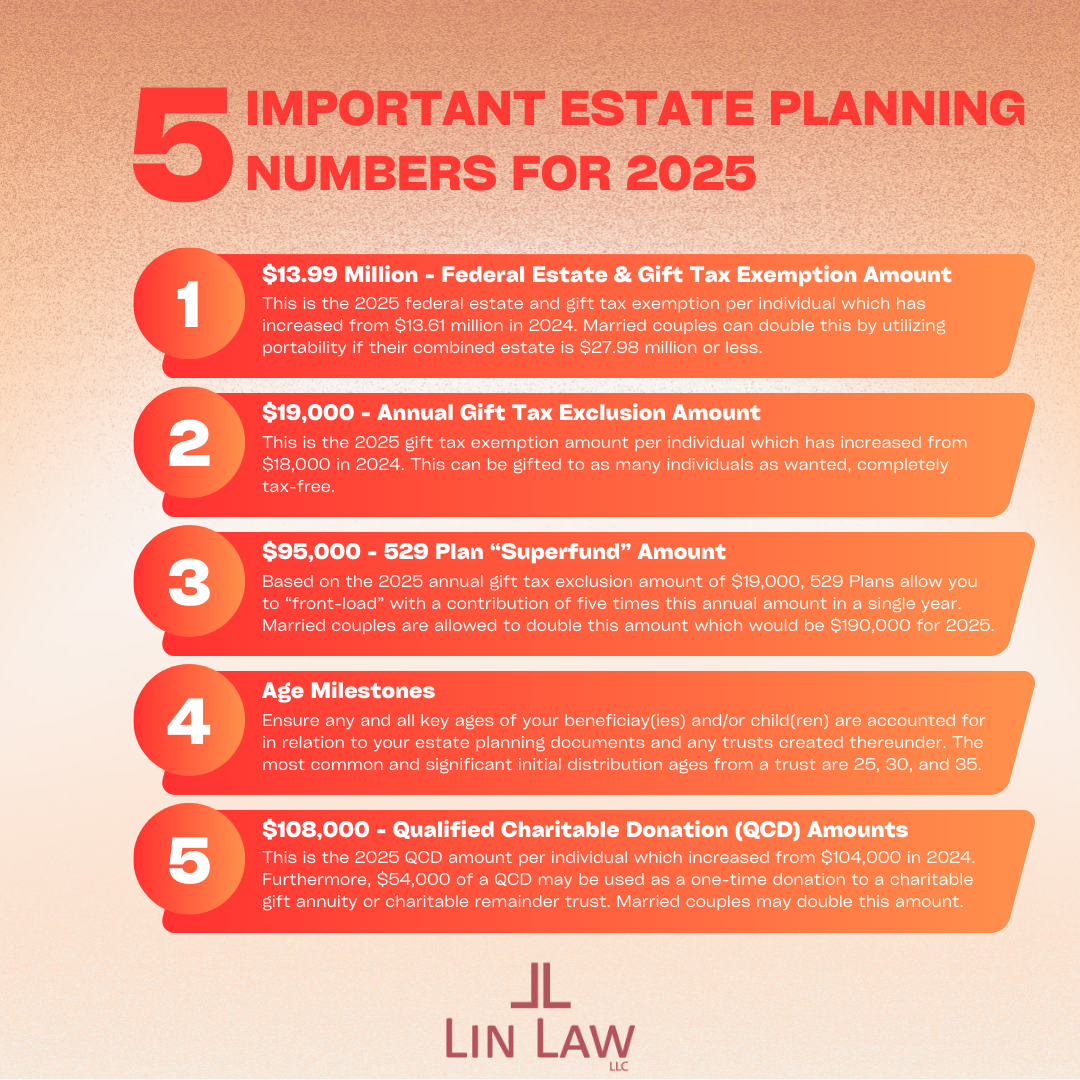

The New Year is here, and with it, it brings many opportunities that can have a significant impact when it comes to your estate plan. Here’s a quick breakdown of the five important numbers mentioned above for 2025 and why they matter:

🔻$13.99 Million – Federal Estate & Gift Tax Exemption Amount:

This is the increased amount for 2025 that you have the ability to pass on to your heirs tax-free as an individual. If married couples elect portability, they may combine their exemptions totaling $27.98 million. If your total estate exceeds this amount in any capacity, it may be subject to the federal estate tax. Along with this, the estate tax exemption is scheduled to “sunset” at the end of 2025 and is estimated to decrease by being halved to $7 million per individual.

🔻 $19,000 – Annual Gift Tax Exclusion:

When it comes to the annual gift tax exclusion amount, you may gift this to as many individuals as you would like tax-free. This is a powerful tool for transferring wealth that many people utilize to reduce their taxable estate as it can directly benefit loved ones and are able to see the impact within your lifetime.

🔻 $95,000 – 529 Plan “Superfund” Amount:

The 529 Plan is a very common way that many grandparents, that are fortunate enough to have the means to do so, are able to contribute to their grandchildren’s education. With that being said, the 529 Plan is a tax-advantaged account that an account owner sets up for a minor beneficiary and can be used to pay for any education expenses up until they turn eighteen. Furthermore, by “superfunding” a 529 Plan it allows the account owner to contribute five times the annual gift exclusion amount ($19,000 in 2025) in a single year. In 2025, if an account owner “superfunds” a beneficiary’s account the amount contributed would be $95,000 and this can be doubled for married couples totaling a contribution of $190,000. However, it is important to note that if the account owner decides to “superfund” a beneficiary’s account that they may not contribute any “gifts” to the beneficiary within the next five years or within that year. All in all, the 529 Plan is a wonderful way for grandparents, parents, friends, and others to contribute to a beneficiary’s academic journey.

🔻 Age Milestones for Beneficiaries:

Estate planning is about more than just protecting assets, it’s also about ensuring they are passed down at the right time as well. In this upcoming year, if you have an estate plan it’s important to know if your selected beneficiary(ies) will be turning the pre-selected distribution age and if they are mature enough for this milestone. Delaying inheritance ages till later ensure that your beneficiary(ies) will have better financial responsibility and can provide long-term security. Lastly, if a child of yours or someone that you are a guardian of that will turn eighteen this year, it may be worth it to look into having them acquire their powers of Attorney.

🔻$108,000 – Qualified Charitable Donation (QCD) Amount:

In 2025 for individuals that are 70 ½ and above, they have the ability to contribute $108,000 annually from their IRA to a qualified charity, tax-free. This allows the individual to leave behind a legacy that is meaningful to them that will have a lasting impact while also taking advantage of tax benefits.

Estate planning is more than just numbers, it is being able to create a tailored strategy that is reflective of your lifetime goals and your personal values. In regard to these 2025 updates, an annual review of your estate plan is always a good way to ensure peace of mind when it comes to tailoring the best strategy for you and your loved ones.

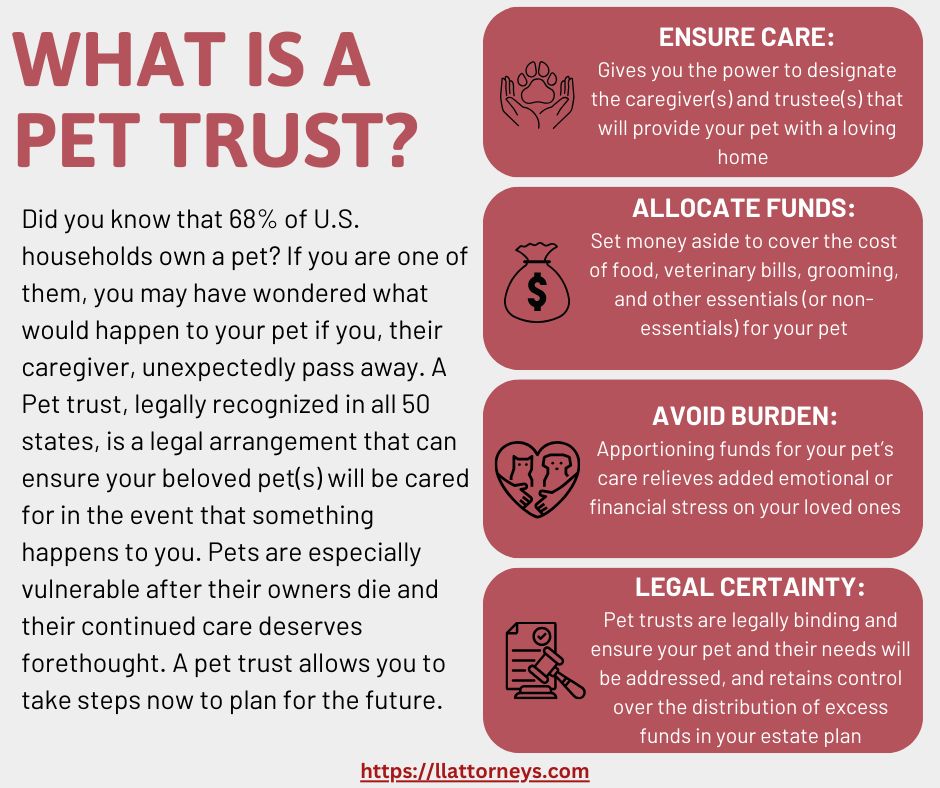

Yes, a pet trust is really a thing. For many, pets are as much a part of the family as you or I. They may not be able to say so, but they deserve a plan, too. Pet trusts are legally binding arrangements that ensure your pet(s) are cared for, according to your wishes, if you are unable to do so due to illness, disability, or passing away. Similar to a trust with human beneficiaries, it allows you to set funds aside specifically for your pet’s needs, appoint one or more trustees to manage the trust’s assets, designate one or more caregivers for your pets, and give detailed instructions for their care. If necessary or desired, you can also compensate the caregiver for your pet’s care. If there are any funds leftover after your pet’s death, you decide who will receive those funds, whether it be your pet’s caregiver, divided among your family or other beneficiaries, or to a charity of your choosing. Pet trusts can provide people with a peace of mind and a sense of certainty that their pet is accounted for and a plan is in place to meet their needs. A pet trust ensures that your beloved companions would continue to receive the love and care that they are used to, no matter what.

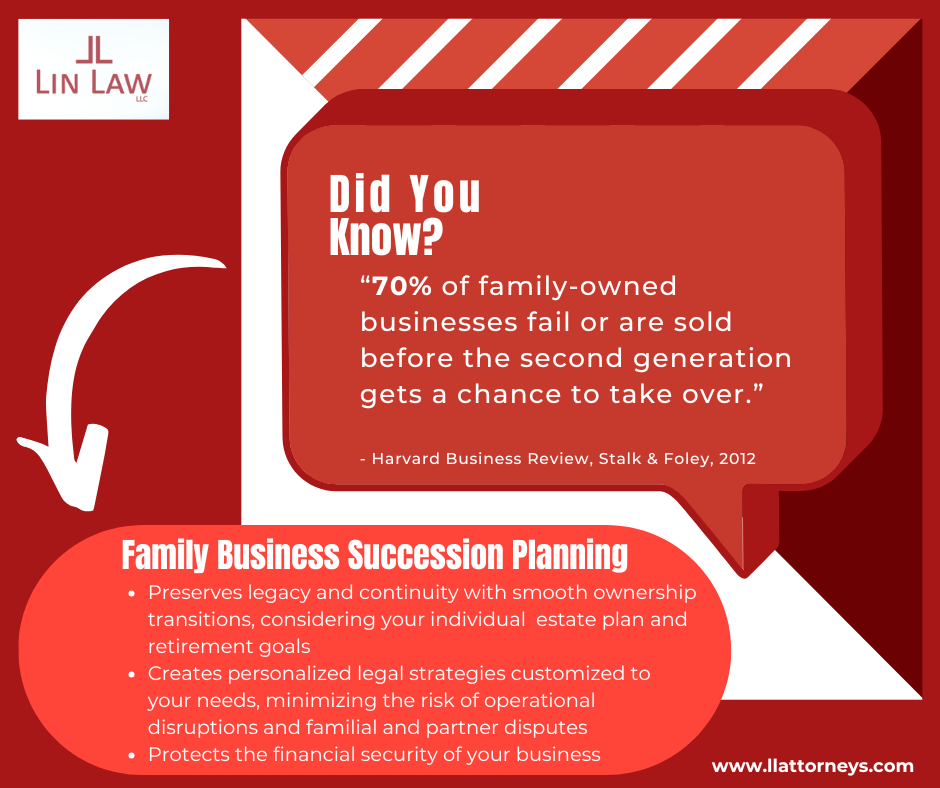

The Harvard Business Review article “Avoid the Traps That Can Destroy Family Business” mentions the statistic that seventy percent (70%) of family-owned businesses do not make it to the second generation. Furthermore, if you don’t want your business to fall into that statistic then proper family business succession planning will be vital to preserving the values, vision and foundation you’ve established for many generations to come. Below we have outlined what we think are key considerations to creating a successful family business succession plan and transition:

🔑 Key Steps for Successful Family Business Succession Planning:

1. The Business Plan:

– Evaluate and assess the business’s current value and its potential for long-term growth

– Choose your successors who will help the business flourish according to your wishes

– Develop a transition strategy with the help of an attorney to outline how how the responsibilities will be transferred along with a timeline

2. The Estate Plan:

– Determine the business and personal asset distribution you want to be divided among your heirs

– With the help of an attorney, ensure the proper legal documents (i.e., living wills, trusts, operating agreements, etc.) are created with clear details to ensure a smooth business ownership transition which will mitigate risk and any potential disputes

– Ensure the best fitting tax strategies are implemented that account for any estate taxes and reduce future financial issues for heirs

3. The Exit Plan:

– Define clear exit goals that consider the transfer of ownership, sale of the business, if you hypothetically want to close it down, and what you want to achieve with all of this in mind

– Prepare the business by improving its value, addressing any issues and optimizing the operations if you plan to sell it

– Take into account the financial and personal impact this will have and adjust your plan accordingly

All in all, family business succession planning helps guarantee that your hard work stays in trusted hands for generations to come. By incorporating your family business success plan into your estate plan, it will address the complexities of ownership transition, division of personal property, minimize taxes, and allow the growth of your business to flourish.

We are pleased to announce, introduce and welcome our newest attorney, Andrew Martzahl, to Lin Law LLC. Andrew brings with him a wealth of experience in the areas of Estate Planning, Business Succession Planning, Probate, Trust Administration, Corporate Law, and Real Estate.

As a Green Bay native and loyal Wisconsinite, Andrew earned his Bachelor’s in Business Administration (BBA) in Finance and Economics from the University of Wisconsin-Madison. After his graduation from UW-Madison, Andrew decided to continue his education and simultaneously earned his law degree from Marquette University Law School, where he graduated cum laude, along with his Master of Business Administration (MBA) from Marquette University. During his time at Marquette, he served as the President of the Marquette Law Estate Planning Society and worked as a research assistant on federal estate tax law.

Furthermore, Andrew’s background includes his legal experience at an Am Law 200 firm—one of the top two-hundred (200) largest law firms in the country, as recognized by Law.com and American Lawyer magazine, where he advised his clients – primarily companies in the manufacturing, food & beverage, and construction industries, and their owners – in the areas of wealth planning, mergers and acquisitions, business and transactional law, and business formation. This distinguished experience has provided him with advanced skills when it comes to delivering comprehensive legal guidance making him an invaluable addition to our team.

Outside of the office, Andrew enjoys the great outdoors where you can find him golfing, hiking, fishing, or hunting. Following that, he is a committed supporter of all Wisconsin sports teams. Naturally, as a die-hard Packers fan, he’s counting down the days until he can hopefully and finally get his own season tickets which he is on the waitlist for.

Please join us in welcoming Andrew to Lin Law LLC! We are excited to see what the future holds for him here and are grateful for his expertise and dedication as we know he will be an invaluable asset to our team and clients alike.