As one would expect, many parents and/or grandparents assume that their children and/or grandchildren will handle inheritance matters amicably when it comes time to receive their share. However, after years of experience in the estate planning industry, it has become clear that this is rarely the case. A different side of a person often comes out when inheritance is involved which is why these types of conflicts within families are unfortunately extremely common. Without proper planning practices in place, disputes over inheritance amounts, real estate, or loans can damage family relationships beyond repair. Although the ability to recognize potential problems is already a significant part of its solution so, here’s our recommendations you should consider to help ensure smooth transitions:

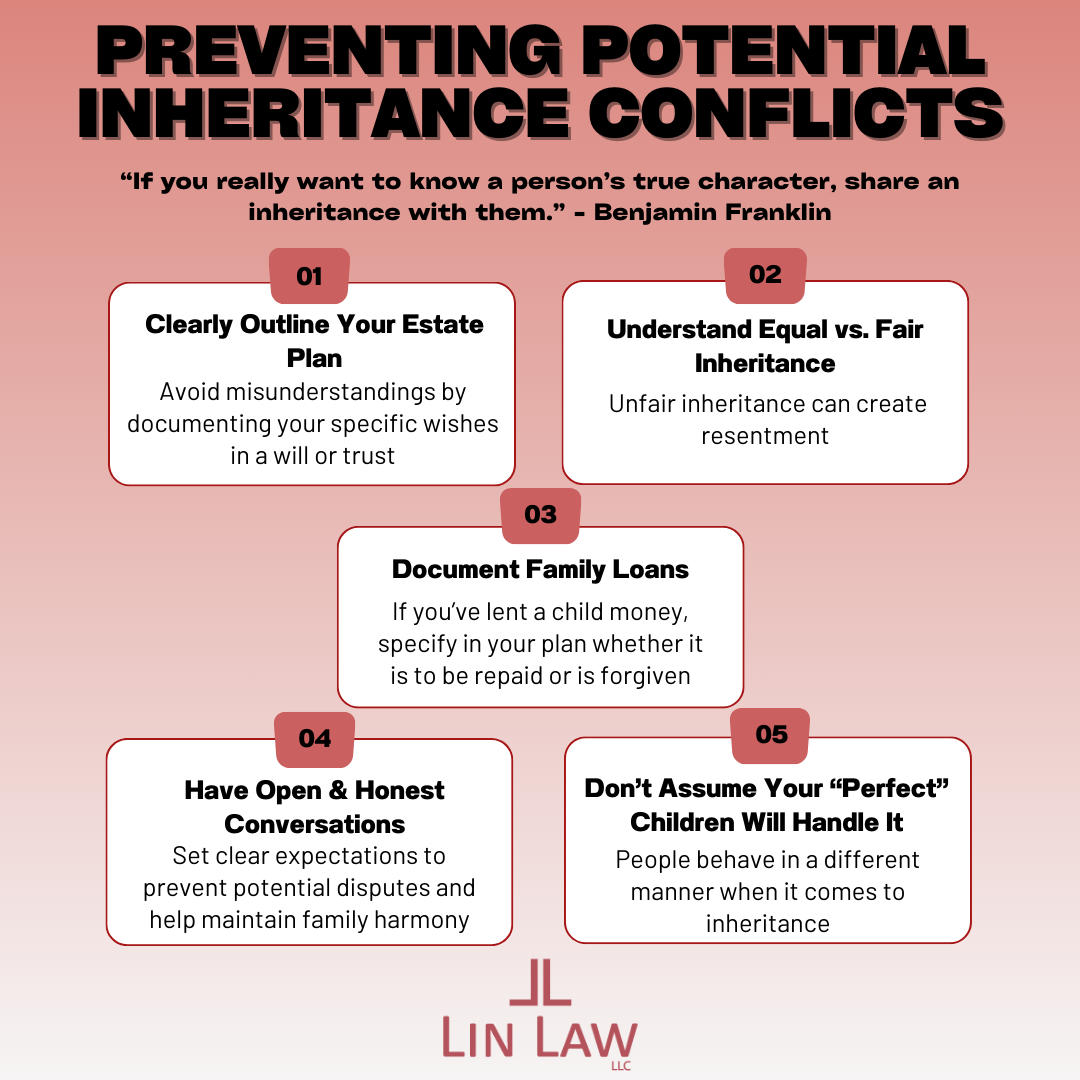

- Clearly Outline Your Estate Plan – Although it may seem obvious, specifically outlining your wishes is key to preventing any misunderstandings and disputes that could come about. Assuming that your children and/or heirs will “figure it out” can lead to greedy assumptions, confusion, and conflict. A well-structured plan detailing who will receive what, how assets will be distributed, and including any other conditions you want will help ensure your wishes are carried out exactly as you intended in a smooth manner.

- Understand Equal vs. Fair Inheritance – When it comes to inheritance distribution, treating all children exactly the same does not always mean treating them fairly. While equally dividing assets seems the least controversial, differences in financial status, child who has dedicated time taking on a caregiving role for a parent, or past parental support can make equality feel unfair in some cases for specific family members. Instead of adjusting inheritance amounts, you can gift assets during your lifetime to support a child in need of more financial assistance, if need be. If one child has received more financial support, a life insurance policy could help equalize the estate by providing additional funds to the other heirs to offset this. All in all, if you plan to distribute your assets unequally it may be helpful to explain your reasoning and thoughts to all of your children in advance. This level of transparency can help prevent surprises and reduce any potential misunderstandings.

- Document Family Loans – Loans between parents and children are fairly common especially when it’s for a home down payment, vehicle, education, starting a new business, or time of a financial hardship. However, these informal arrangements can lead to conflict if they are not properly addressed as the line between loan and gift can become blurred over time. A formal promissory note can help establish that the money was a loan not a gift. If you would like the loan to be repaid, specify in detail how you would like this handled after your passing. Otherwise, if you want to forgive the loan, clearly state this in your estate plan so everyone understands. Lastly, if one child received a large loan that will be forgiven you may want to offset this difference through life insurance cash, or other assets for your other children.

- Have Open & Honest Conversations – Estate planning is most definitely a confidential and private matter but, choosing to have open conversations with your children and family about your wishes could make all the difference in mitigating the risk of future disputes. Talking about estate planning does matter and can help your family understand what your intentions are behind decisions made to prevent feelings of blind sidedness. By openly addressing concerns or questions your family has in advance, this facilitates more understanding and can help maintain family harmony. Allowing for open communication allows your family to have the chance to bring up insights that you may not have considered that could possibly align better with your family’s needs. We know that these conversations can be difficult and uncomfortable, but having the opportunity to address it before conflicts arise is a powerful way to protect family relationships.

- Don’t Assume Your “Perfect” Children Will Handle It – We know that parents and grandparents alike want to believe their children will respect their decisions, divide assets fairly, and handle these matters with the utmost maturity. However, inheritance can bring out many intense emotions, tensions, and hidden family dynamics that many grandparents and parents could’ve never anticipated. The emotions can run very high as the passing of a parent is an already emotional time which can amplify any existing tensions such as long-standing sibling rivalries or perceived parental favoritism that can quickly resurface. Your children may have assumptions about what they feel “entitled” to, and if these aren’t met, they may feel deeply hurt or betrayed especially when it comes to a family home, business, or heirloom. Even if your children are mature, loving, and get along well now, inheritance can bring out very unexpected behaviors which is why transparency, clearing detailing your wishes, effective communication, and possibly utilizing a professional trustee can protect your family’s relationships after you’re gone.