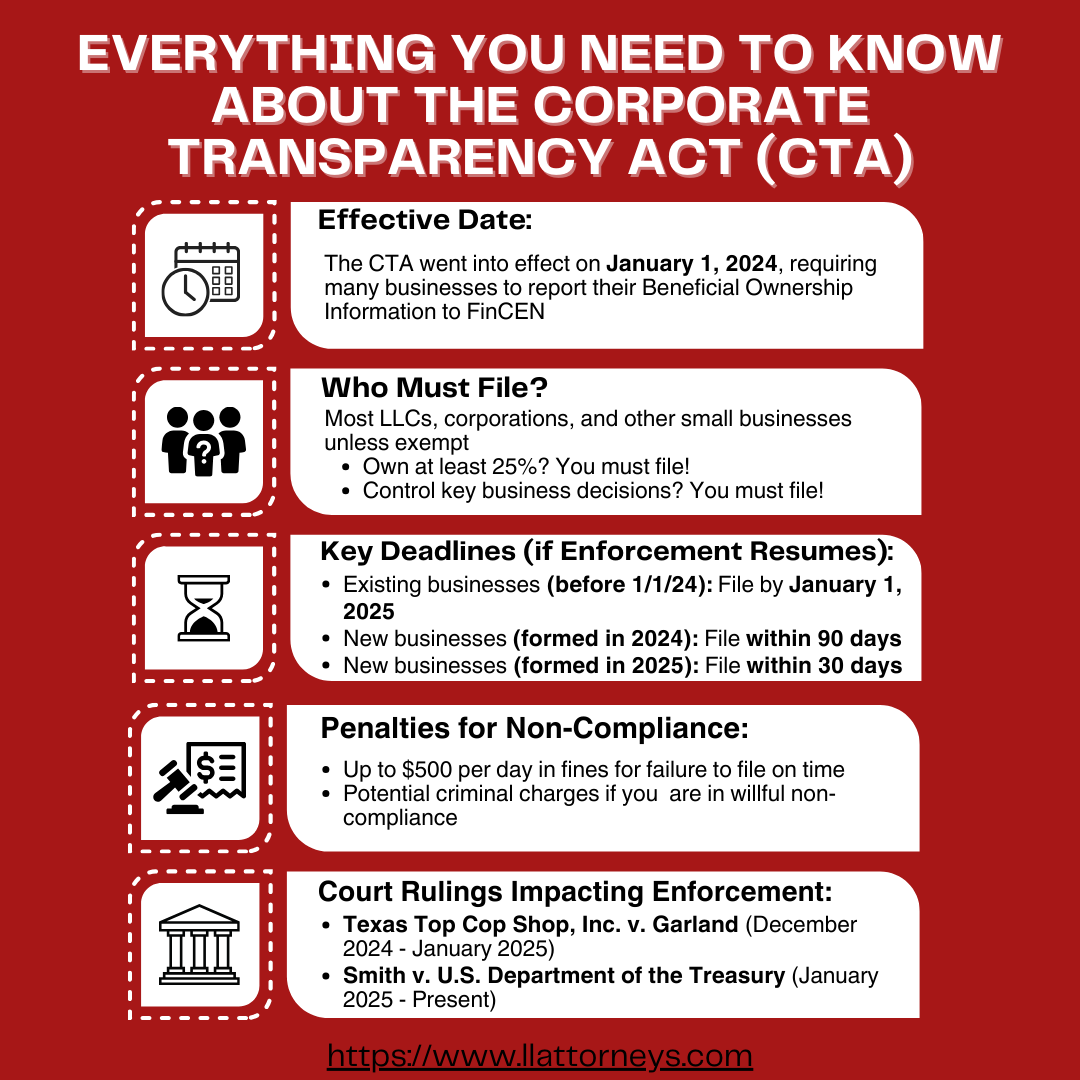

One of the major developments in estate planning and corporate law was the passage of the Corporate Transparency Act (CTA), which went into effect on January 1, 2024. The CTA impacted almost all LLCs, corporations, limited partnerships, and other closely held business entities by creating a requirement that a “Beneficial Ownership Information Report”, or “BOIR”, be filed with the Financial Crimes Enforcement Network (FinCEN), a federal bureau within the United States Department of the Treasury. Subject to a few limited exceptions, this reporting requirement applies to all business entities with less than 20 full time employees. In the BOIR, entities and their owners were required to provide personal identifying information on all individuals that exercise substantial control over the entity, as well as all individuals that own or control at least 25% of the entity’s ownership interests. The CTA’s overall purpose is to prevent the use of companies, such as corporations, limited liability companies, and various forms of limited partnerships, to obscure illicit activities and to increase business operations ethics and transparency. In Furtherance of these objectives, the CTA requires businesses, subject to a few exceptions, to disclose information regarding individuals who own at least twenty-five percent (25%) or exercise majority control over the company must report their information.

As of the present date, there are two cases challenging the constitutionality of the CTA. Under both cases (Texas Top Cop Shop v. Garland and Smith v. U.S. Department of the Treasury), nationwide injunctions were enacted preventing enforcement of the CTA. For the time being, reporting companies are not required to file BOIRs with FinCEN. However, the injunctions have been previously lifted only to be subsequently re-enacted as they have made their way to the U.S. Supreme Court. On December 3, 2024, the U.S. District Court for the E.D. Texas in Texas Cop Shop enacted a nationwide injunction that temporarily blocked enforcement of the CTA. A second injunction soon followed in Smith. Then, on December 23, 2024, the nationwide injunction was lifted when it was overturned by the Fifth Circuit Court of Appeals. Scrambling, and in recognition that many reporting companies stopped filing their BOIR, FinCEN extended the deadline to file an initial BOIR to January 13, 2025. Before the January 13 deadline, the U.S. District Court for the E.D. Texas issued another nationwide injunction in Smith. While the nationwide injunction remains in place under Smith, the U.S. Supreme Court has indicated a willingness to uphold the validity of the CTA when they lifted the nationwide injunction enacted in Texas Top Cop Shop on January 23, 2025.

It is critical to ensure you are compliant with the CTA reporting requirements. If enforcement of the CTA resumes, non-compliant companies could face substantial penalties, including fines of five-hundred dollars ($500) per day and/or possible additional penalties and criminal charges for intentional violations. Going forward, if the CTA is upheld, FinCEN will likely extend initial reporting deadlines for any entities that have not yet filed a BOIR. This was the case following a temporary lifting of the nationwide injunctions on December 23, 2024, when the initial reporting deadline was extended to January 13, 2025. Entities formed after January 1, 2025, must file their initial BOI report within thirty (30) days of their formation. In order to ensure compliance, if necessary, it is also critical to monitor the progress of these cases as they proceed to the U.S. Supreme Court on their merits. If ultimately upheld, new deadlines for compliance will likely be imposed.

Lastly, if the CTA is ultimately upheld, it is important to keep in mind that the initial BOIR filing is only the first requirement under the CTA. Each instance where the information reported for a beneficial owner changes (including, but not limited to, if the reporting company’s address or name changes, if ownership composition of the reporting company changes, or if an owner’s name or address changes), then a subsequent BOIR must be reported within 30 days of such change.