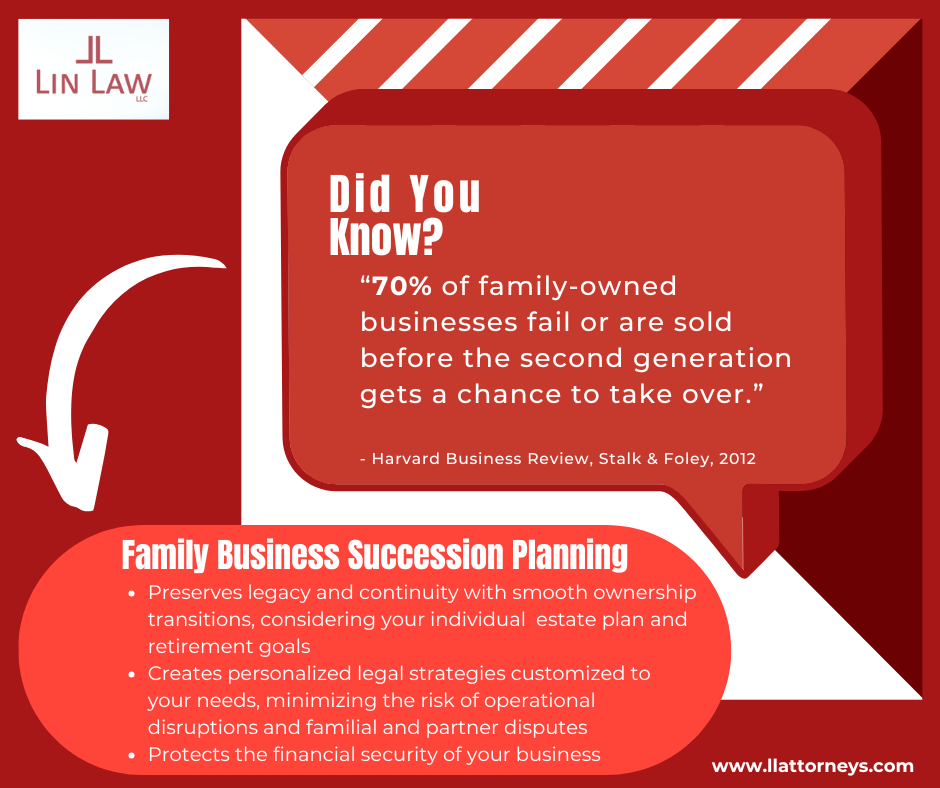

The Harvard Business Review article “Avoid the Traps That Can Destroy Family Business” mentions the statistic that seventy percent (70%) of family-owned businesses do not make it to the second generation. Furthermore, if you don’t want your business to fall into that statistic then proper family business succession planning will be vital to preserving the values, vision and foundation you’ve established for many generations to come. Below we have outlined what we think are key considerations to creating a successful family business succession plan and transition:

🔑 Key Steps for Successful Family Business Succession Planning:

1. The Business Plan:

– Evaluate and assess the business’s current value and its potential for long-term growth

– Choose your successors who will help the business flourish according to your wishes

– Develop a transition strategy with the help of an attorney to outline how how the responsibilities will be transferred along with a timeline

2. The Estate Plan:

– Determine the business and personal asset distribution you want to be divided among your heirs

– With the help of an attorney, ensure the proper legal documents (i.e., living wills, trusts, operating agreements, etc.) are created with clear details to ensure a smooth business ownership transition which will mitigate risk and any potential disputes

– Ensure the best fitting tax strategies are implemented that account for any estate taxes and reduce future financial issues for heirs

3. The Exit Plan:

– Define clear exit goals that consider the transfer of ownership, sale of the business, if you hypothetically want to close it down, and what you want to achieve with all of this in mind

– Prepare the business by improving its value, addressing any issues and optimizing the operations if you plan to sell it

– Take into account the financial and personal impact this will have and adjust your plan accordingly

All in all, family business succession planning helps guarantee that your hard work stays in trusted hands for generations to come. By incorporating your family business success plan into your estate plan, it will address the complexities of ownership transition, division of personal property, minimize taxes, and allow the growth of your business to flourish.