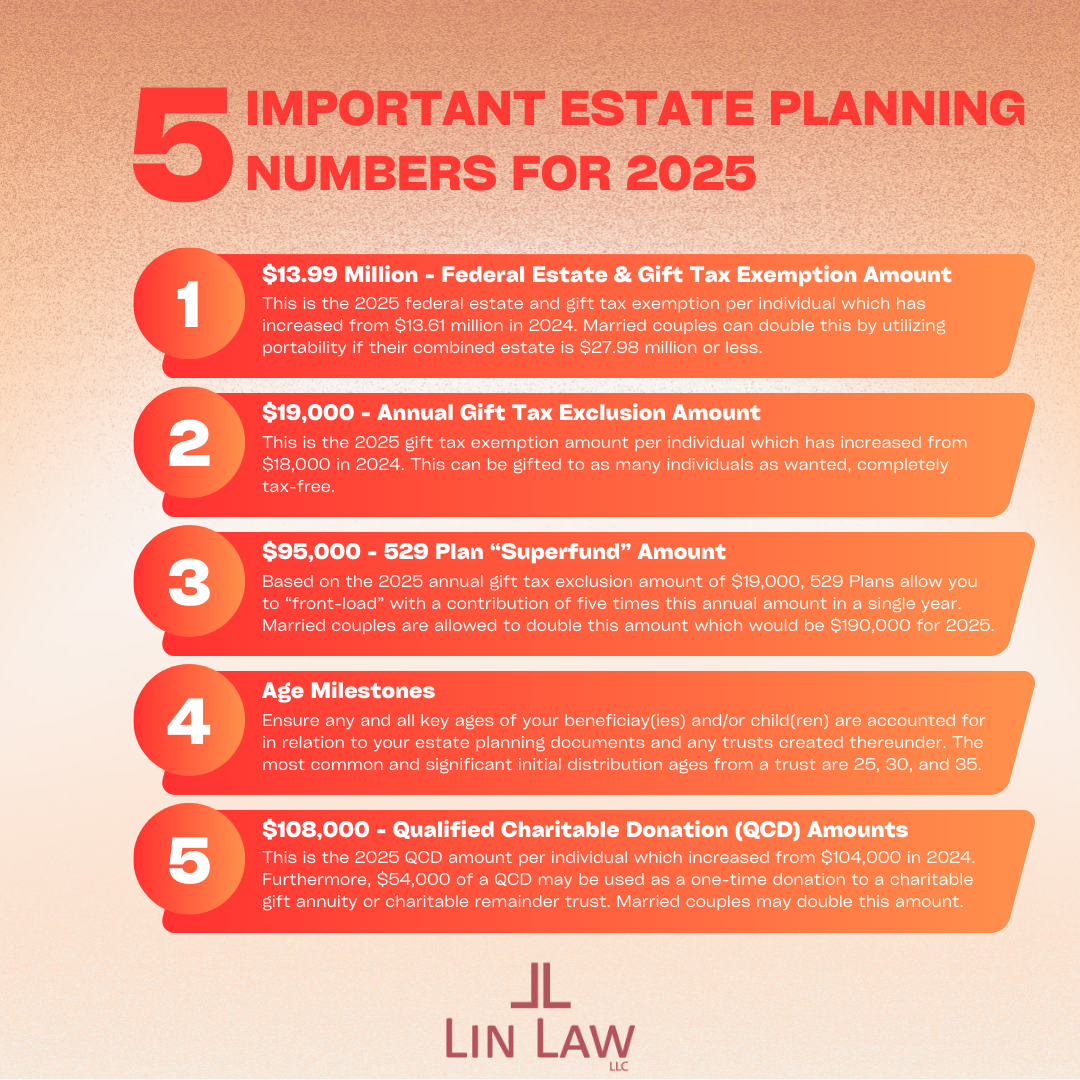

The New Year is here, and with it, it brings many opportunities that can have a significant impact when it comes to your estate plan. Here’s a quick breakdown of the five important numbers mentioned above for 2025 and why they matter:

🔻$13.99 Million – Federal Estate & Gift Tax Exemption Amount:

This is the increased amount for 2025 that you have the ability to pass on to your heirs tax-free as an individual. If married couples elect portability, they may combine their exemptions totaling $27.98 million. If your total estate exceeds this amount in any capacity, it may be subject to the federal estate tax. Along with this, the estate tax exemption is scheduled to “sunset” at the end of 2025 and is estimated to decrease by being halved to $7 million per individual.

🔻 $19,000 – Annual Gift Tax Exclusion:

When it comes to the annual gift tax exclusion amount, you may gift this to as many individuals as you would like tax-free. This is a powerful tool for transferring wealth that many people utilize to reduce their taxable estate as it can directly benefit loved ones and are able to see the impact within your lifetime.

🔻 $95,000 – 529 Plan “Superfund” Amount:

The 529 Plan is a very common way that many grandparents, that are fortunate enough to have the means to do so, are able to contribute to their grandchildren’s education. With that being said, the 529 Plan is a tax-advantaged account that an account owner sets up for a minor beneficiary and can be used to pay for any education expenses up until they turn eighteen. Furthermore, by “superfunding” a 529 Plan it allows the account owner to contribute five times the annual gift exclusion amount ($19,000 in 2025) in a single year. In 2025, if an account owner “superfunds” a beneficiary’s account the amount contributed would be $95,000 and this can be doubled for married couples totaling a contribution of $190,000. However, it is important to note that if the account owner decides to “superfund” a beneficiary’s account that they may not contribute any “gifts” to the beneficiary within the next five years or within that year. All in all, the 529 Plan is a wonderful way for grandparents, parents, friends, and others to contribute to a beneficiary’s academic journey.

🔻 Age Milestones for Beneficiaries:

Estate planning is about more than just protecting assets, it’s also about ensuring they are passed down at the right time as well. In this upcoming year, if you have an estate plan it’s important to know if your selected beneficiary(ies) will be turning the pre-selected distribution age and if they are mature enough for this milestone. Delaying inheritance ages till later ensure that your beneficiary(ies) will have better financial responsibility and can provide long-term security. Lastly, if a child of yours or someone that you are a guardian of that will turn eighteen this year, it may be worth it to look into having them acquire their powers of Attorney.

🔻$108,000 – Qualified Charitable Donation (QCD) Amount:

In 2025 for individuals that are 70 ½ and above, they have the ability to contribute $108,000 annually from their IRA to a qualified charity, tax-free. This allows the individual to leave behind a legacy that is meaningful to them that will have a lasting impact while also taking advantage of tax benefits.

Estate planning is more than just numbers, it is being able to create a tailored strategy that is reflective of your lifetime goals and your personal values. In regard to these 2025 updates, an annual review of your estate plan is always a good way to ensure peace of mind when it comes to tailoring the best strategy for you and your loved ones.